What is MEV?

“Maximal extractable value (MEV) refers to the maximum value that can be extracted from block production in excess of the standard block reward and gas fees by including, excluding, and changing the order of transactions in a block,” (Ethereum.org).

MEV exists because people (i.e., ‘seachers’) have found novel ways of making money on Ethereum by including, excluding and/or reordering transactions; this typically requires the ability to communicate with miners and have them build blocks accordingly. Currently, miners are the gatekeepers deciding whether an MEV opportunity is included in a particular block. That said, it is the group of searchers that find the opportunities and submit them for inclusion. The overall profit from these activities represents MEV; and this is split between the searchers who find these profitable strategies and the miners who must be paid to arrange transactions.

Why is MEV a good thing?

Some of the positive aspects of MEV:

- Realizing the full value of the network. By optimizing a block and achieving its highest value, the value of the network is increased. To be sure, higher gas prices are not cause for celebration, but that would seem to be more of a bandwidth or scalability issue.

- Beneficial transactions (arbitrage, liquidations and privacy). Arbitrage and liquidations are common trades that flow through MEV infrastructure. Arbitrage is a useful activity that keeps prices aligned between, say, a DEX’s AMM price and the price of the broader market. Liquidations are important for the smooth operation of over-collateralized lending platforms like Maker DAO, for instance. Privacy is not the end goal of MEV, but it is an integral piece. Many users seek privacy for their transactions until they are included on chain. This kind of transaction privacy has been popularized partially through MEV activities (for more see here).

- Network Security. Just as MEV activities can be seen to destabilize a network (see below) it can also lead to improved security. MEV will increase the yield available to validators post merge. All else equal an increase in staking yield is likely to lead to more stake, which implies a higher cost of attacking the network.

Listing the positives and negatives does not imply an either/or decision with respect to MEV. The practical approach is to attempt to retain the positive elements while reducing the negative aspects.

Ed Felten of Arbitrum (an optimistic rollup) recently gave a talk at MEV-day where he talked about the possibility of having two different avenues for Arbitrum – one in which MEV was restricted and a second where MEV is enabled and the rewards are shared with users; the key point that users could opt in to the MEV-enabled version if they chose – this is the ideal solution.

What are the potential pitfalls of MEV?

Some of the key concerns around MEV are:

- Exploitation of users. Certain transactions such as sandwich attacks or Just-In-Time (JIT) liquidity attacks seek to frontrun users, predominantly on decentralized exchanges, or DEXes.

- Elevated gas prices. The idea is that as searchers bid up blockspace, gas prices will consistently increase and push out other users. Though there is some truth to this, it appears more likely that MEV activities create short term, outsized fluctuations in gas prices rather than prolonged upward pressure – the way that new apps do, for instance (e.g., cryptokitties).

- Blockchain security. There is a potential for instability with MEV – if the incentive is high enough, miners could engage in behaviors that are detrimental to Ethereum. For instance, miners could attempt to “rewrite history”; this is known as a reorganization (or reorg; for more see here). Some kinds of reorgs are an ongoing concern but will be almost entirely eliminated post merge (due to the much higher cost of attacking the network), while other kinds have been eliminated by the introduction of proposer boost (see here).

What Stakers need to know:

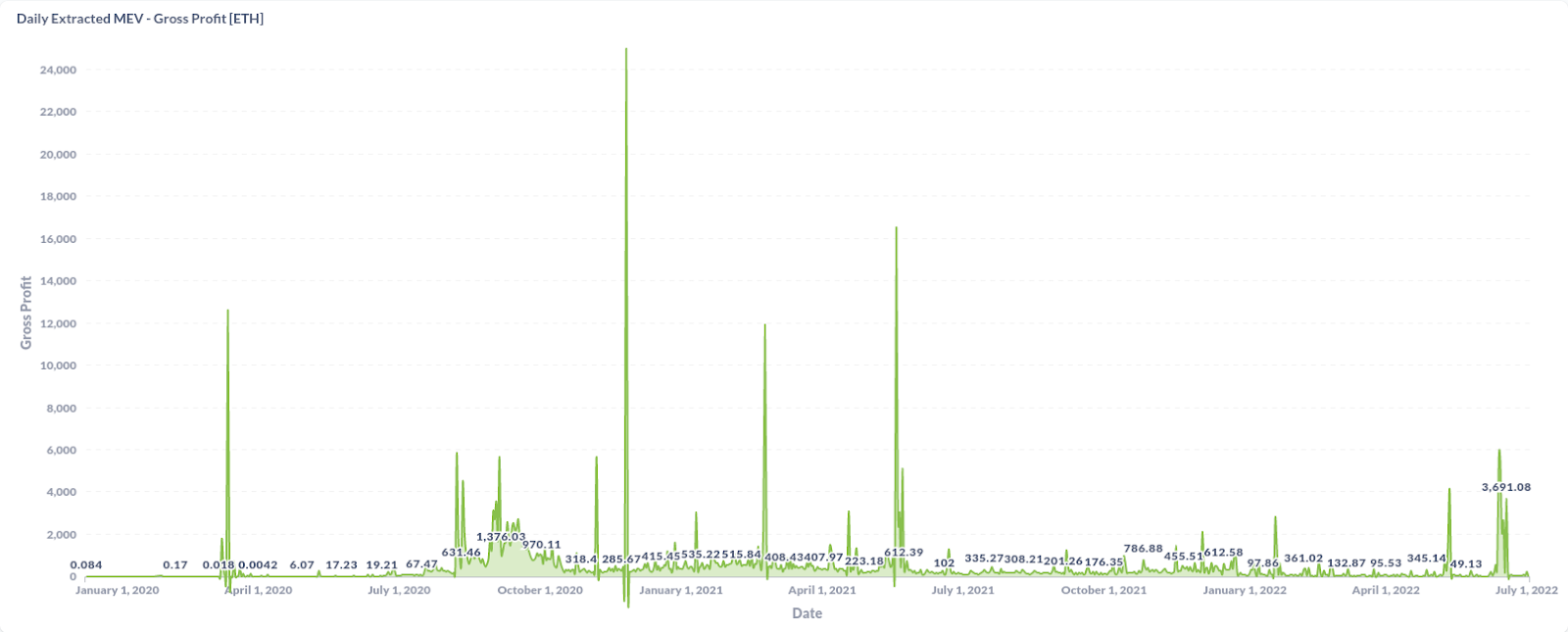

MEV has the potential to add anywhere between 0.25% and 21% to post merge yields for stakers. Another consideration is that the volatility of MEV revenue is much higher than the typical volatility of staking rewards as represented in the next series of charts.

The above chart shows the gross profit of daily extracted MEV (in ETH) on Flashbots. You can see numerous peaks – the highest one being 24,000 ETH (!!).

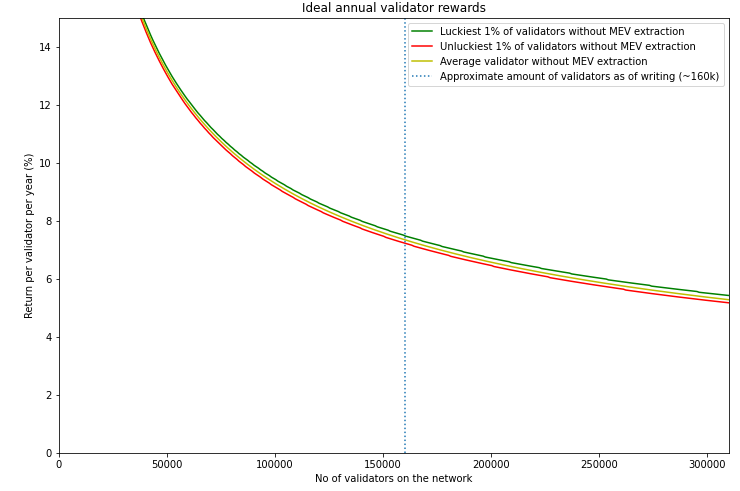

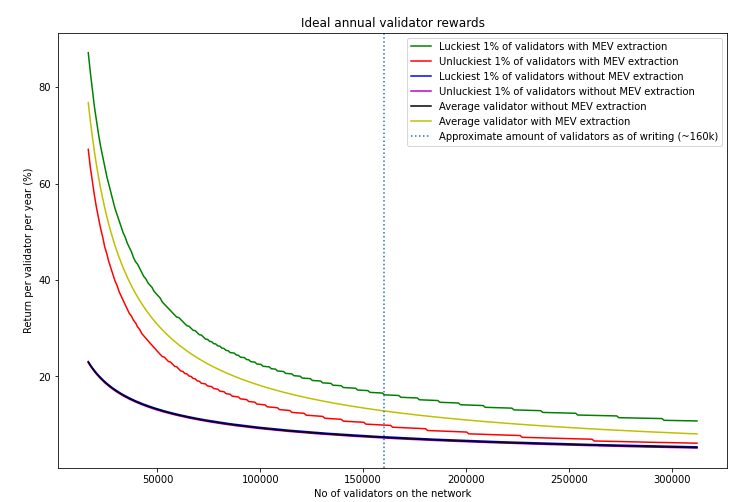

The chart above shows the rewards for the luckiest 1% of validators, the average and the unluckiest 1% of validators all without MEV. Compare this to the next chart, showing the same figures but including MEV. Notice the change in the chart scale and the much greater dispersion.

(Source: Flashbots – MEV in Eth2 – an early exploration)

How much MEV will stakers get? A decent first cut would be for staking service providers to charge the same commission on MEV revenue as staking rewards. With that said, the community is still learning what MEV in a post merge world will look like. Additionally, the lift will be different for different teams, i.e., there is no ‘one size fits all’ approach.

MEV and the Merge

Currently miners have little incentive to share their MEV rewards. However, when these rewards begin to accrue to validators the picture changes. Staking service providers are much more in the public eye – they have a reputation and they face competition. An attempt to hoard MEV rewards would damage reputations and would likely be a losing business strategy in the medium to long term. Staking service providers are likely to share the vast majority of rewards with stakers, as mentioned above.

How should validators engage with MEV?

Currently Flashbots appears to be the best way to engage in MEV – it is permissionless, transparent and fair. Additionally, related to transparency, Flashbots produces a lot of data and research. This research and data feeds into education. If the strategy is to allow MEV and leave it to apps, layer-2s, protocols, etc built on top of Ethereum to manage it themselves then education is vitally important.

Figment, along with many other large staking service providers, pools, tech and client groups are part of the Flashbots Working Group; per its charter: “The goal of the Flashbots Eth2 Working Group is to ensure that there is a fair and efficient MEV solution adopted by PoS validators on Ethereum post-merge.” The benefit of having the largest staking providers agree in principle on an approach like Flashbots would be extremely helpful – not only does it indicate that staking service providers seek to foster the long term health of Ethereum it also does so in a transparent way.