The Inter Protocol is a community orchestrated, decentralized application debuting on the Agoric network that utilizes the Inter Stable Token, also known as IST. IST is overcollateralized, designed to maintain parity with the US Dollar for comprehensive availability and to provide Agoric users with minimum price volatility. IST also provides core functionality and stability for the Agoric chain.

The Agoric chain is connected to other chains through the Inter-Blockchain Communication (IBC) protocol. The interchain ecosystem does not currently have a stable token backed by a variety of available assets such as OSMO, ATOM, and SCRT. IST allows users to mint IST against their interchain assets by making it available to all chains in the thriving IBC ecosystem. Users can use IST as collateral and take part in cross-chain DeFi. Furthermore, IST serves as the native fee token for the Agoric platform and is distributed to users who stake BLD in the form of rewards. Governance on the platform is conducted by BLD holders acting as the BLDer DAO. The DAO elects an economic committee that can suggest changes to the parameters such as collateral types, rules of IST issuance, liquidation process etc.

Enter Inter Protocol

Any user can permissionlessly deposit crypto collateral into their vault and mint IST in return. It is important to note that only governance approved cryptocurrencies may be used as collateral. Users are charged a minting fee which is payable back when they return the IST to free up their initial collateral. The fees are deposited into the Reserve Pool that supports the Inter Protocols stability and into the Rewards Pool which is used to reward BLD stakers. The Reserve pool serves two essential roles. First, to provide liquidity to Swap with liquidity for liquidations. Second, act as an emergency fund that acts as a backup in case of a major liquidation.

How much IST can I borrow?

The amount a user is allowed to borrow is dependent on the value of collateral used to mint IST. The collateralization ratio is determined through governance. If the dollar value of the collateral falls below the ratio, the Inter Protocol will liquidate the collateral to pay off the IST debt and charge a liquidation penalty.

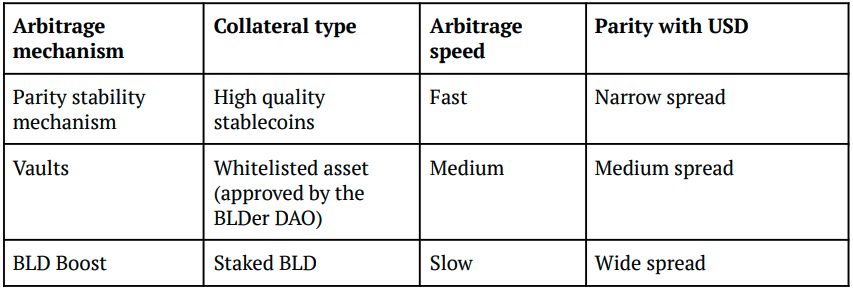

IST maintains its stable parity with the US Dollar by using 3 market based arbitrage mechanisms that work simultaneously. All 3 systems use different assets, work at different speeds and track different bands of parity to ensure IST maintains its parity to the US Dollar.

The 3 mechanisms are listed below:

Vaults

In simple terms, Vaults can be classified as smart contracts where users collateralize crypto assets and mint IST. Users are charged a minting fee and interest rate on the borrowed IST. The minting fee is charged when the IST is borrowed, and the interest accrues while the loan is open. The borrower must pay the loan plus the accrued fees in order to retrieve their assets. It is to be kept in mind that Vaults are subject to liquidation in case the USD value of the collateralized asset falls below the collateralization ratio. Liquidation mainly occurs by selling the collateral on ‘Swap’, an Agoric native automated market maker (AMM). The Inter Protocol maintains pools on Swap and consists of each governance approved collateral type and IST.

BLD Boost

Another method of minting IST is by using BLD Boost. This method is only available to users who stake their BLD token. Once BLD is delegated to an active validator, delegators can lock up a portion of the stake and mint IST against it. The debt is repaid through future staking rewards. Despite the lock up, the BLD will continue to accrue rewards, however, can not be unstaked until the loan is paid back. BLD Boost is a very attractive option for most users since the locked up BLD is not subject to liquidation.

Parity Stability Module

Lastly, Agoric users can trade high caliber stable coins such as USDC for newly-minted IST tokens. This is a fast and low cost method.

Security and Protection

The Inter Protocol uses multiple methods to ensure economic protection against losses.

- Overcollateralization

Assets are overcollateralized therefore, the liquidation threshold always has an edge to ensure no major losses are incurred.

- Liquidation

Assets will be liquidated as soon as the USD value of the collateralized asset falls below the threshold

- Reserve Pool

In case of a major shortfall the Reserve Pool will help cover any potential losses.

- IST fess

If the Reserve Pool is not enough to cover the losses, fees flowing into the reserve pool will be used to cover the rest.

- BLD Issuance

Last resort, if any losses cannot be covered by the Reserve Pool and Fees, BLDer DAO can vote to issue additional BLD to owed IST.

The Inter Stable Token (IST) is going to establish a new standard for stable tokens on the Cosmos ecosystem. It would allow Cosmos users to conveniently and quickly transfer their assets across different chains while ensuring the value of their asset remains 1:1. IST would allow the Cosmos Ecosystem to actively compete with other chains and their stable tokens such as Tether (USDT) and Binance USD (BUSD). By allowing a greater opportunity for Cosmos Defi, IST would attract a lot more users to the ecosystem and kick start the development of a lot more projects centered around Cosmos interoperability.