Cardano is a blockchain-driven by scientific research, designed to be scalable, interoperable, and environmentally sustainable. In addition, the network runs its own version of the Proof-Of-Stake consensus algorithm called Ouroboros, allowing users to stake and earn rewards for helping secure the network.

Quick Takes

- Monetary expansion rate currently set at 0.3% per epoch

- No unbounding period

- Token supply in circulation is 33.5 billion

- Maximum supply of ADA is 45 billion

- Estimated annual reward rate between 5% – 6%

Network Economics Overview

The ADA token on Cardano’s network is primarily used for three things:

- Staking – ADA token holders can stake to validators operating on Cardano.

- Fees – dApps will use ADA tokens to pay for transactions on Cardano’s network.

- Governance – ADA token holders who stake their ADA tokens will be able to participate in on-chain governance and vote on development proposals.

Cardano Economics

Cardano validators (pool operators) and their respective delegators earn rewards every epoch (5 days) on the Cardano Network. Rewards are a combination of monetary expansion and from transaction fees.

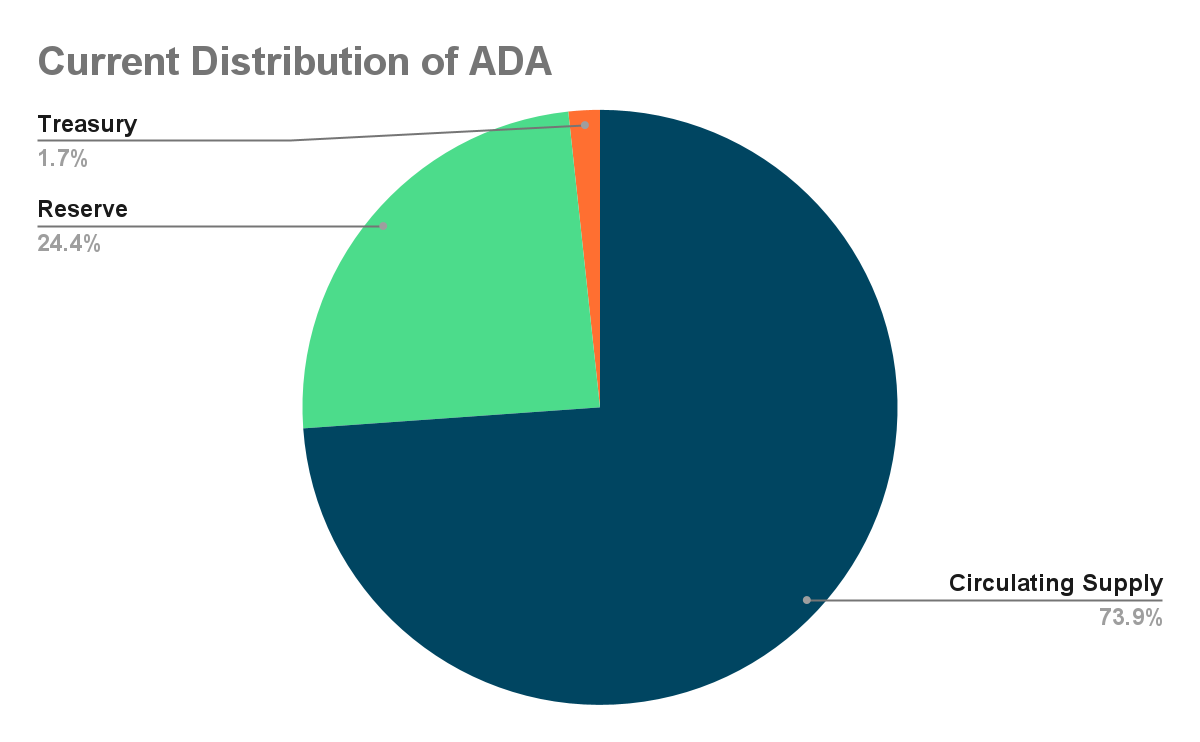

The monetary expansion comes from the reserve; the reserve is determined by the difference between the total supply of ADA and the maximal supply of ADA. The total supply of ADA consists of all ADA currently in circulation, plus the ADA in the treasury. In contrast, the maximum supply of ADA is 45 billion.

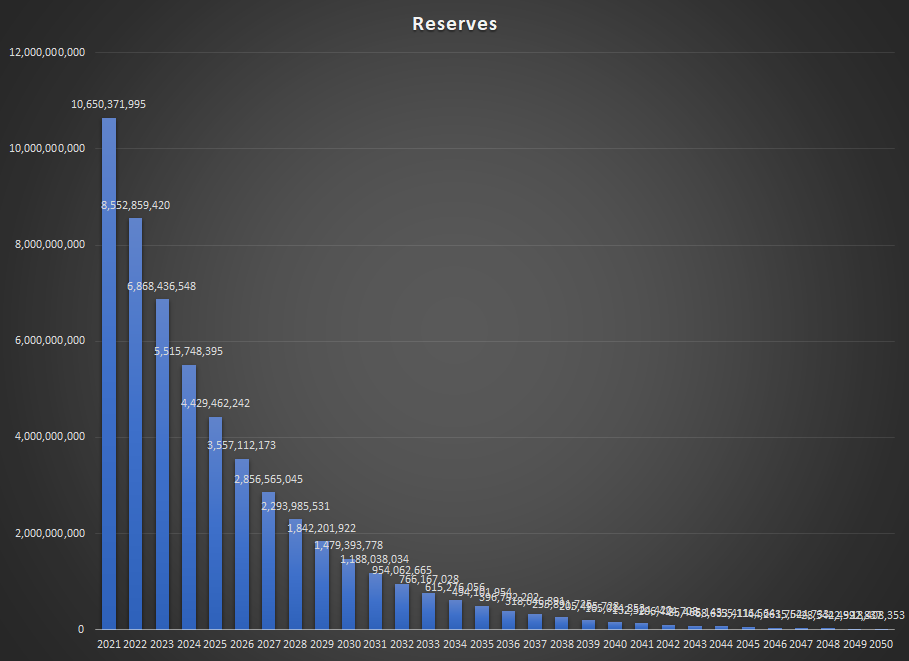

During each epoch, 0.3% of the reserve is distributed as staking rewards and treasury funding, and this will continue to be the case for a couple of years until exhaustion.

From the total two sources of income, a certain percentage – currently set at 20% – goes to the treasury, and the remaining 80% is used to reward staking operators and delegators.

The treasury, also known in the community as the pot, will be used for further development of the network, system improvements, projects voted by the community, and to ensure the long-term sustainability of Cardano.

ADA Token

Cardano’s native token is called ADA and the token has a maximum supply of 45,000,000,000. The current circulating supply is 33.5 billion as of February 2022.

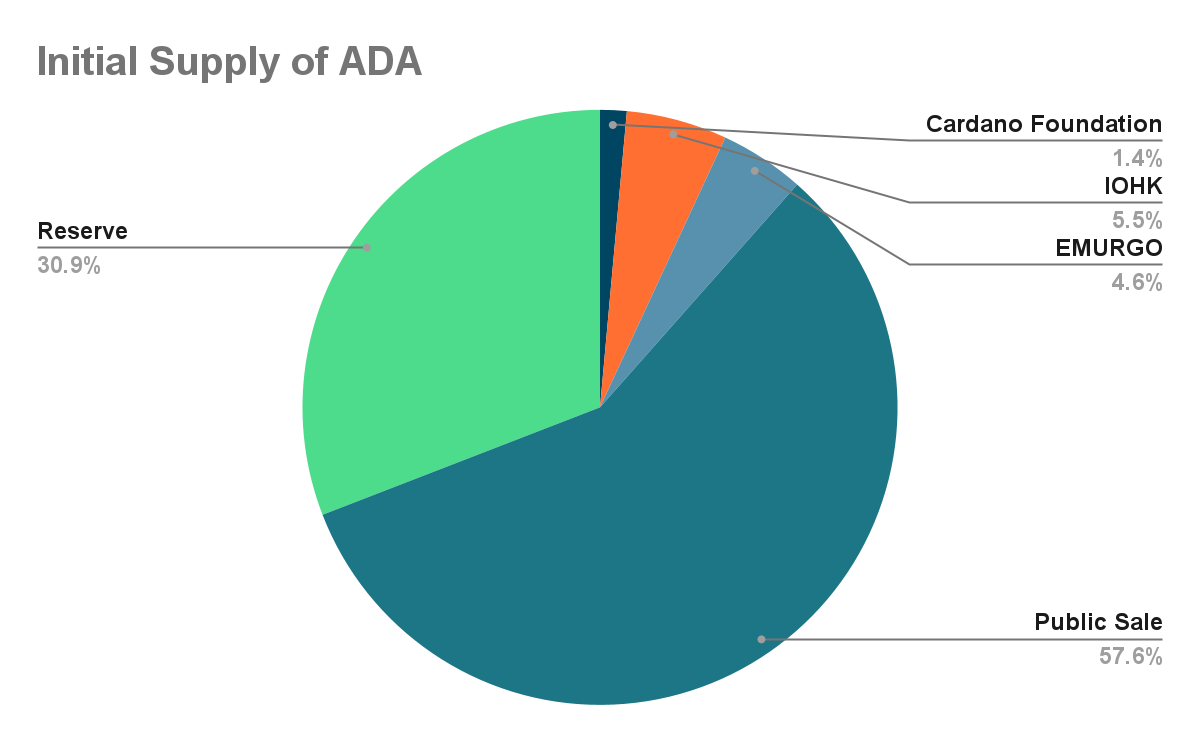

At genesis block distribution, a total of 25,927,070,538 ADA was sold to investors, and the equivalent to 20% of that amount – 5,185,414,108 ADA – was distributed between the three main entities (IOHK, EMURGO and Cardano Foundation).

Therefore, a total amount of 31,112,484,646 ADA was available at Cardano’s official launch, with a total of 13,887,515,354 ADA set as the reserve for staking incentivization.

- Public Sale: 25.9 billion ADA – (57.6%)

- Reserve: 13.9 billion ADA – (30.9%)

- IOHK: 2.46 billion ADA – (5.5%)

- EMURGO: 2.07 billion – (4.6%)

- Cardano Foundation: 640 million ADA – (1.4%)

The expansion rate of monetary expansion is currently set at 0.3%, which means that 0.3% of the reserve balance is released per epoch. That sets off an annual inflation of ~2.0%.

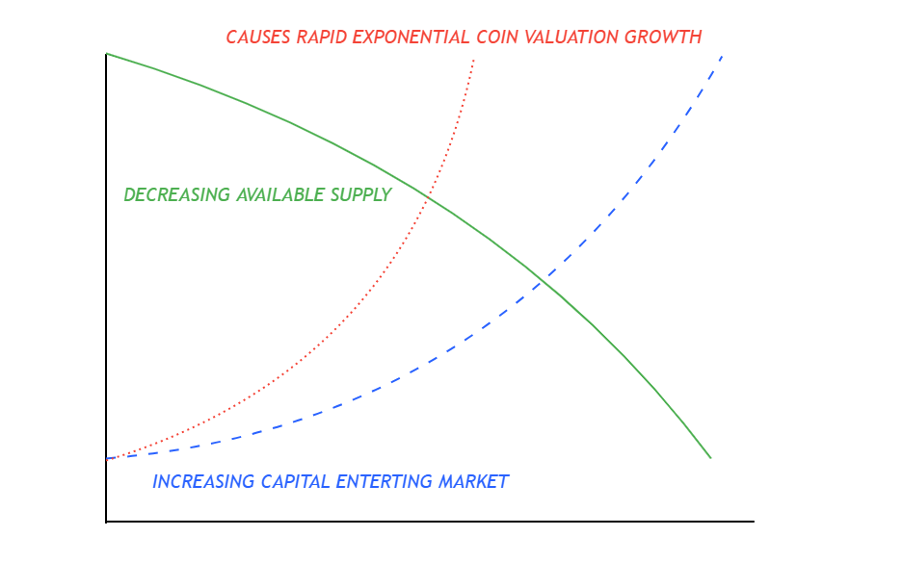

The monetary expansion is non-linear; greater amounts of ADA are released during the first years of the network but will decrease over time. By then, it’s expected that most rewards will come from transaction fees, solidified by the usage and adoption of the network.

ADA can be used as an exchange of value – token holders can stake it and earn rewards for participating in securing the network. They can also use it to pay for transactions in various applications and services on the network. Eventually, the ADA token will also be used as a voting mechanism in on-chain governance.

Cardano provides two native wallets – the Daedalus Wallet, a full-node desktop wallet developed by IOHK that serves a technically inclined audience, and Yoroi Wallet, a lighter wallet developed by EMURGO that has a simple and beginner-friendly approach for mobile users.

Staking ADA

Validators – also known as pool operators, charge a commission fee for running staking pools. Delegators earn staking rewards proportional to what they have staked. Every 5 days – 1 epoch, staking income is automatically allocated and compounded by the protocol.

Delegators may choose and delegate to any staking pool; there’s no lock-up period and users can freely move up their stake. There’s also no unbounding period and stakers may withdraw their rewards at will.

However, there’s a latency period of 15-20 days (i.e., three epochs) for the initial stake to start earning rewards. If you are interested in Staking ADA with Figment, contact sales@figment.io

Pool Mechanics

When staking, delegators should carefully consider which staking pool they delegate to, as many factors might impact their accrued staking reward;

- Fixed cost: There’s a fixed fee of 340 ADA to every pool. It technically covers the pool’s operating costs.

- Margin: There’s an arbitrary percentage taken from the rewards by each pool operator after the fixed cost. It corresponds to the validator commission fee.

- Expansion rate: Currently, ∼0.3% of the reserve is emitted per epoch as staking rewards.

- Pledge amount: An optional and arbitrary amount of ADA that operators might add to have “skin in the game” and that also contributes to earning more rewards. This represents the validator’s self-bound and commitment to the pool.

Delegators need to be attentive and not delegate to “over-saturated pools”, i.e. pools with more stake than they are supposed to.

Cardano establishes certain parameters (such as “parameter K”) that define how many pools there should be in the network and an estimated cap for their respective stake. This architecture guarantees network decentralization.

While there is no punishment applied to a saturated pool and its stake, any amount of stake that surpasses the cap (called “saturation point”) will not earn additional rewards, therefore disincentivizing delegators to add to it. The saturation point is currently close to ~68mm ADA.

Reward Rate

The expansion rate is currently set at 0.3% and the treasury’s cut is 20% of the total income generated. Rewards depend on the pool’s performance and the delegator earns according to their amount of stake, minus the commissions fee. Delegators can expect a staking APY of approximately 5% at the current rate.

Risks

Cardano does not apply any kind of slashing; its architecture and the Ouroboros protocol incentivize node operators to stay honest and keep running at all times. Therefore, delegator’s stakes are never at risk of being slashed.

More information on the economics of Cardano can be found on Cardano’s website. Further specifics on staking pools can be found in Cardano’s documentation and FAQs section.