What is dYdX?

Originally founded in 2017 as a simple margin trading platform, dYdX has evolved into a premier decentralized derivatives exchange supporting perpetual futures across 36 digital assets. After initially building on Ethereum Layer 1, dYdX migrated to Starkware Layer 2, and is now moving to its own Cosmos app-chain. dYdX offers users permissionless trading with low fees and leverage options.

Significant protocol upgrades now include an internally built orderbook, perpetual futures contracts, and architectural improvements as part of the shift to its own Cosmos app-chain. These innovations underscore dYdX’s commitment to an optimized trading experience, showcasing the DEX as a leading destination for decentralized derivatives trading and asset management.

What to Know About dYdX Before Staking

dYdX uses Proof-of-Stake consensus to allow token holders to help secure the network, confirm transactions, and earn rewards from trading fees on the protocol.

dYdX Token

1,000,000,000 initial dYdX tokens were minted and are scheduled to be released over a 5 year time horizon (2021-2026). After this time, dYdX governance allows for token holders to enact up to a 2% maximum annual inflation rate. All new inflation tokens will flow to the community treasury.

dYdX Governance

All dYdX token holders can propose and vote on protocol proposals; one token held equals one vote.

Key dYdX Staking Considerations

Before staking dYdX, it is important to understand a few key staking considerations:

- Unbonding period: 30 days

- Slashing penalties: Downtime and double-signing are both eligible for slashing. When a validator double-signs they are removed from the validator set and are unable to join again.

dYdX Staking Rewards

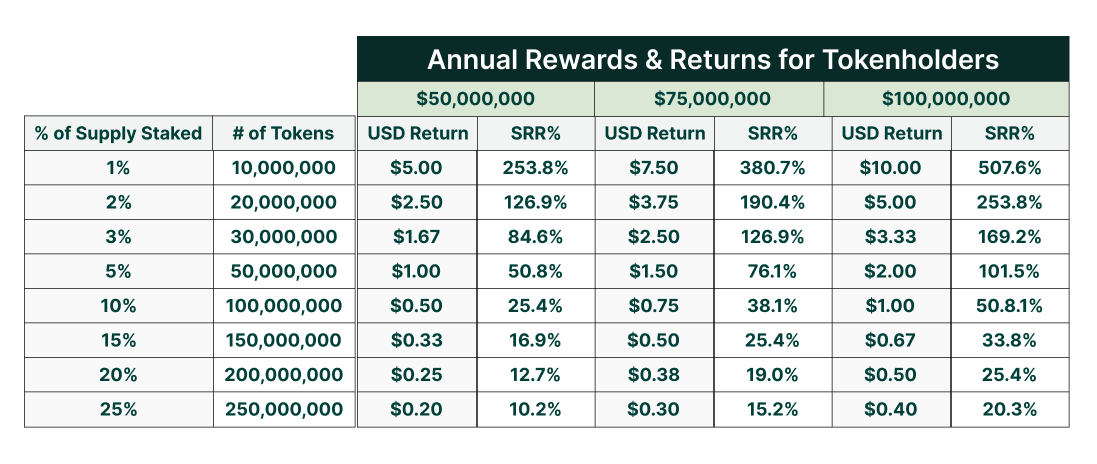

The network offers unique incentives for staking the dYdX token. The protocol generates USD-denominated trading rewards that are then paid out to stakers in USDC every block (~1 second). We’ve laid out some hypothetical staking payouts below.

Key assumptions include:

- $1.97 / dYdX token price.

- Rewards: Based on annualized prior epoch trading rewards, dYdX would generate about ~$50 M in trading rewards in the next 12 months.

Choosing a Validator to Stake dYdX

Choosing the right validator for stakingdYdX tokens is a critical decision for any investor seeking to optimize their rewards while minimizing risks. The role of a validator is pivotal in maintaining the network’s integrity and ensuring consistent rewards. This is where Figment stands out as a leading Staking-as-a-Service (StaaS) provider. With our robust and transparent infrastructure, we optimize for uptime and efficient network participation, both of which are crucial for maximizing staking rewards.

By choosing Figment as your validator for staking dYdX, you’re not just participating in network security and governance; you’re also aligning with a leader in the staking industry known for its reliability, security, and user-centric approach.

How to Stake dYdX

Open/Install Keplr Wallet

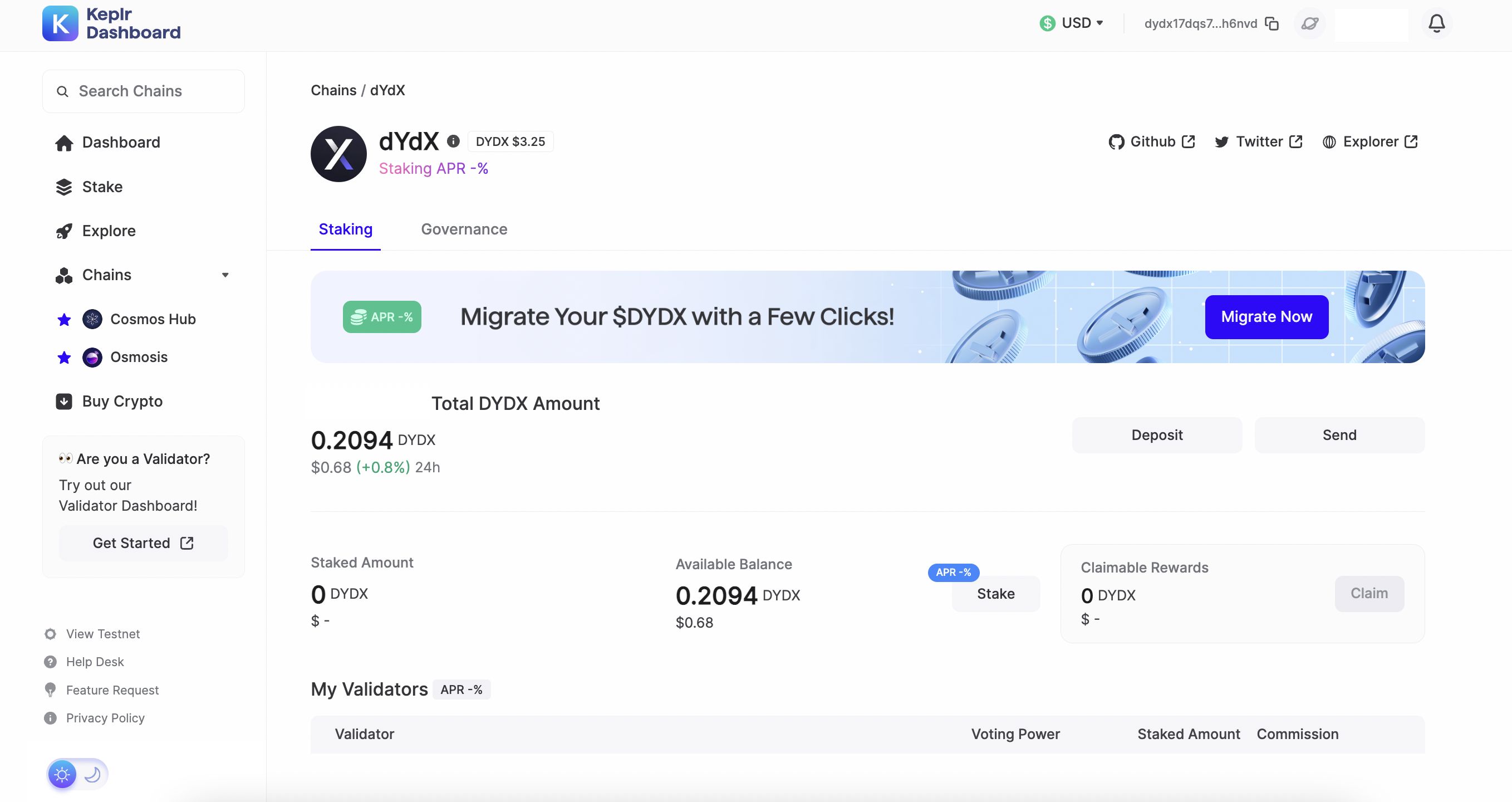

To begin staking dYdX using the Keplr wallet, head over to the dYdX Keplr wallet dashboard.

If you do not have Keplr wallet installed, visit the Chrome store here.

Here on the Keplr Dashboard, ensure you are on the “dYdX” page. This is where you will continue to stake.

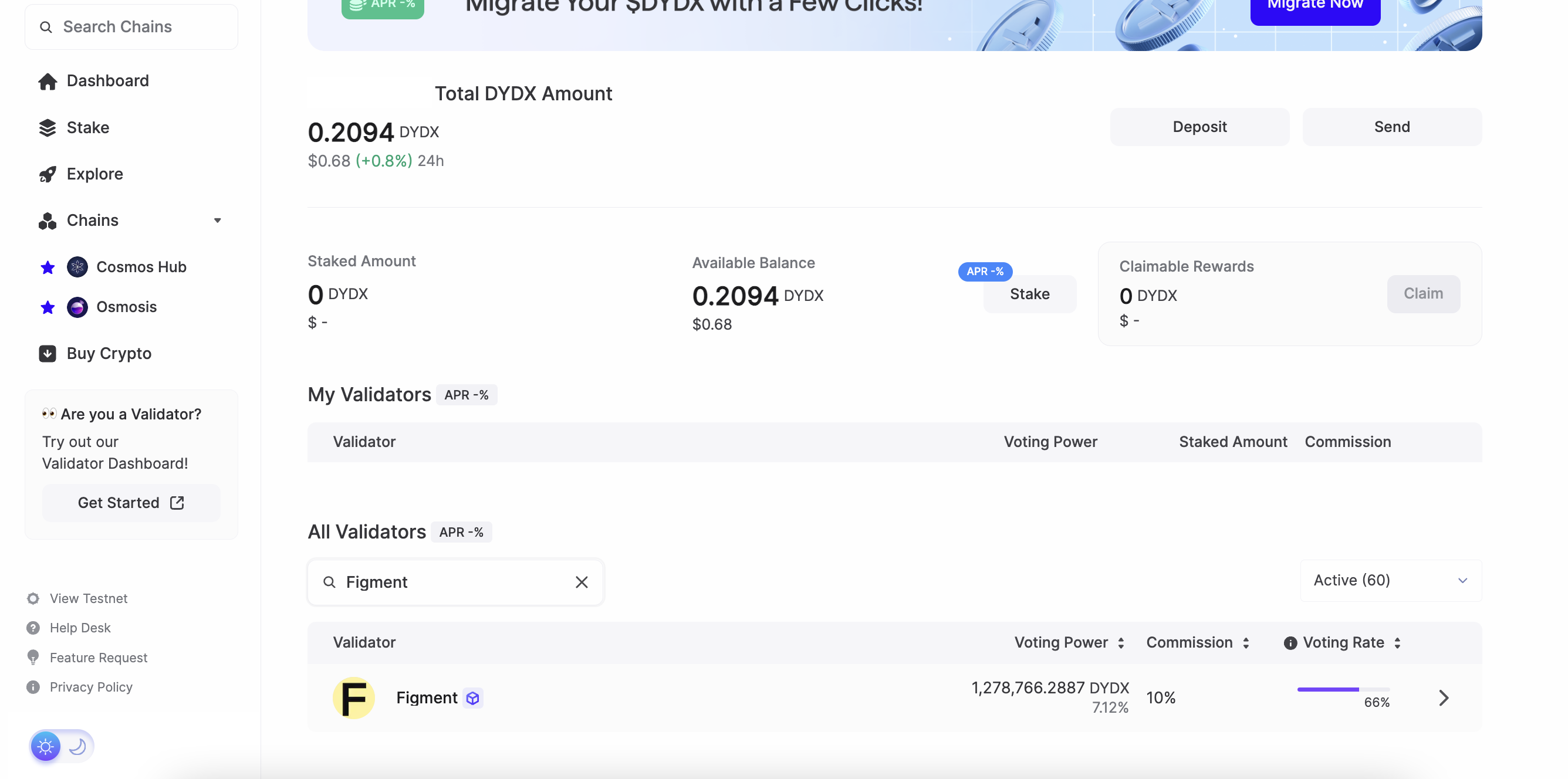

Search for the Figment Validator

To begin the staking process with Figment, search for “Figment” under “All Validators” below.

If you are having trouble finding the Figment validator, view the full details here.

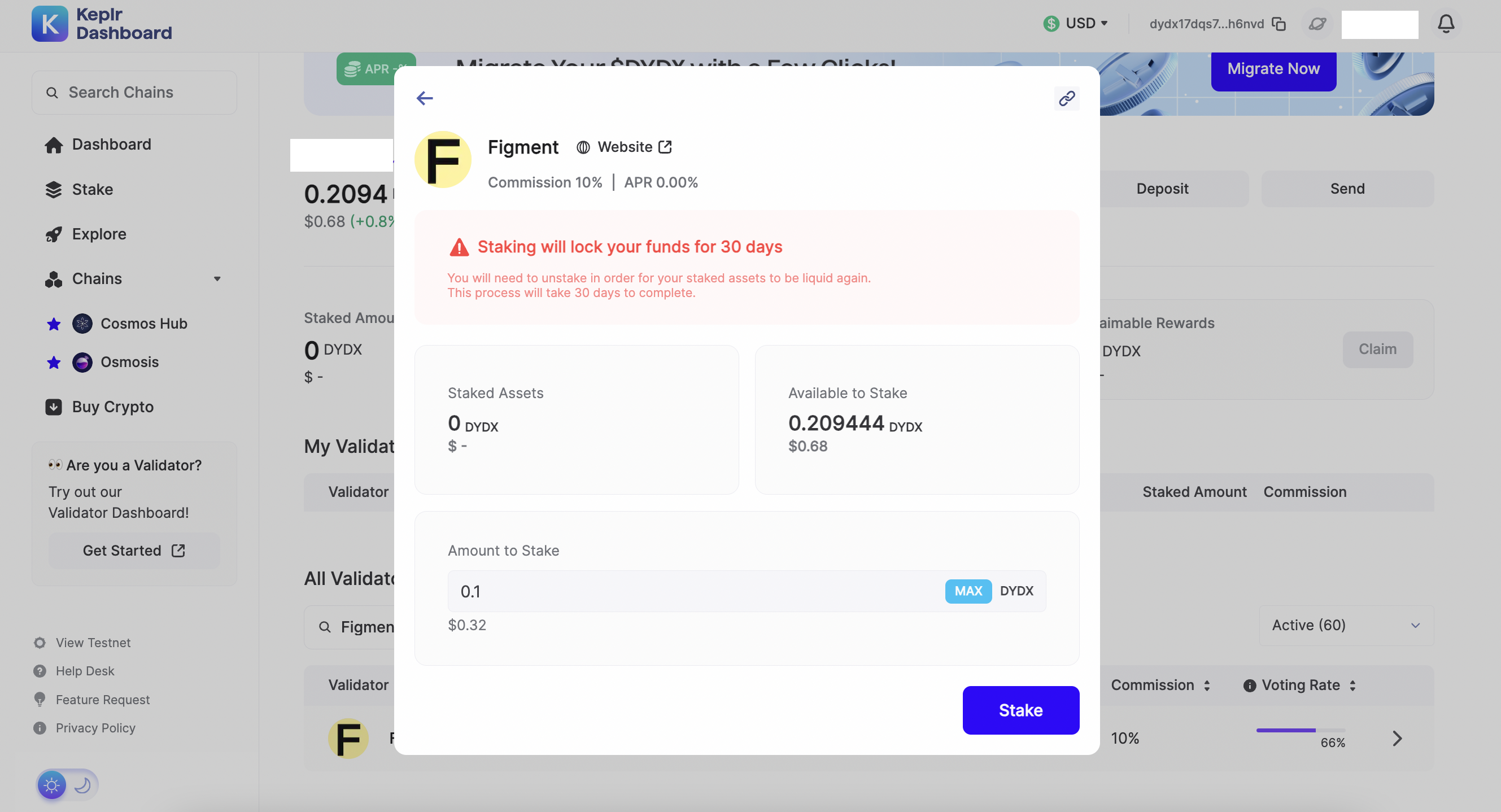

Once you have found the Figment validator, select it, and then click “Stake” when you are ready to begin staking tokens.

Stake dYdX Tokens

When you are ready to stake your dYdX tokens, input the amount you wish to stake, and click “Stake.”

As a reminder, tokens are locked during staking and are subject to a mandatory 30 day unbonding period once they are unstaked.

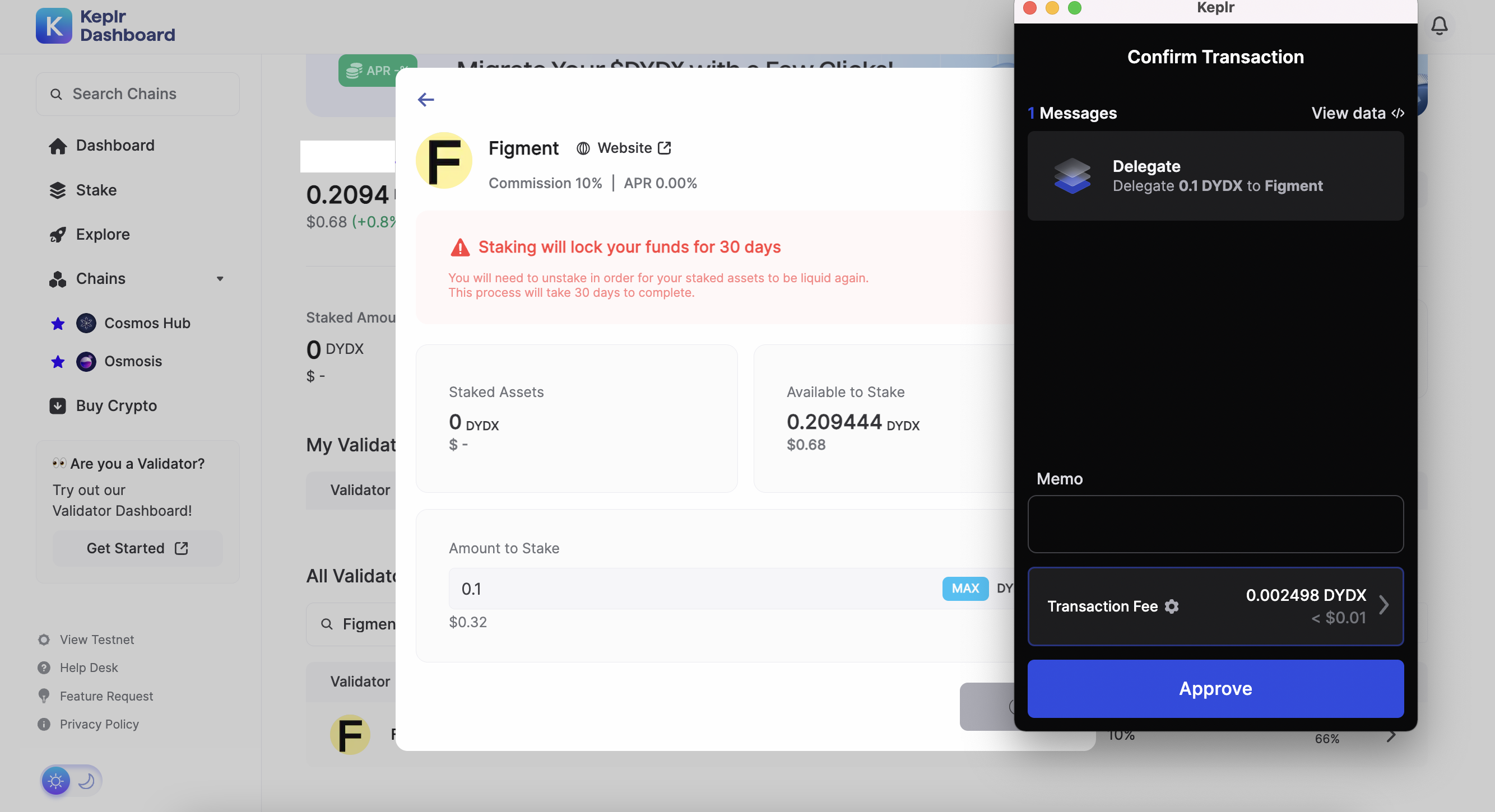

Confirm the Transaction

After clicking “Stake” proceed by confirming the transaction on your Keplr wallet.

Once you’ve confirmed the staking transaction on your Keplr wallet, you will see a “Transaction is in progress” notification in the top right corner of the screen.

Conclude the Staking Process

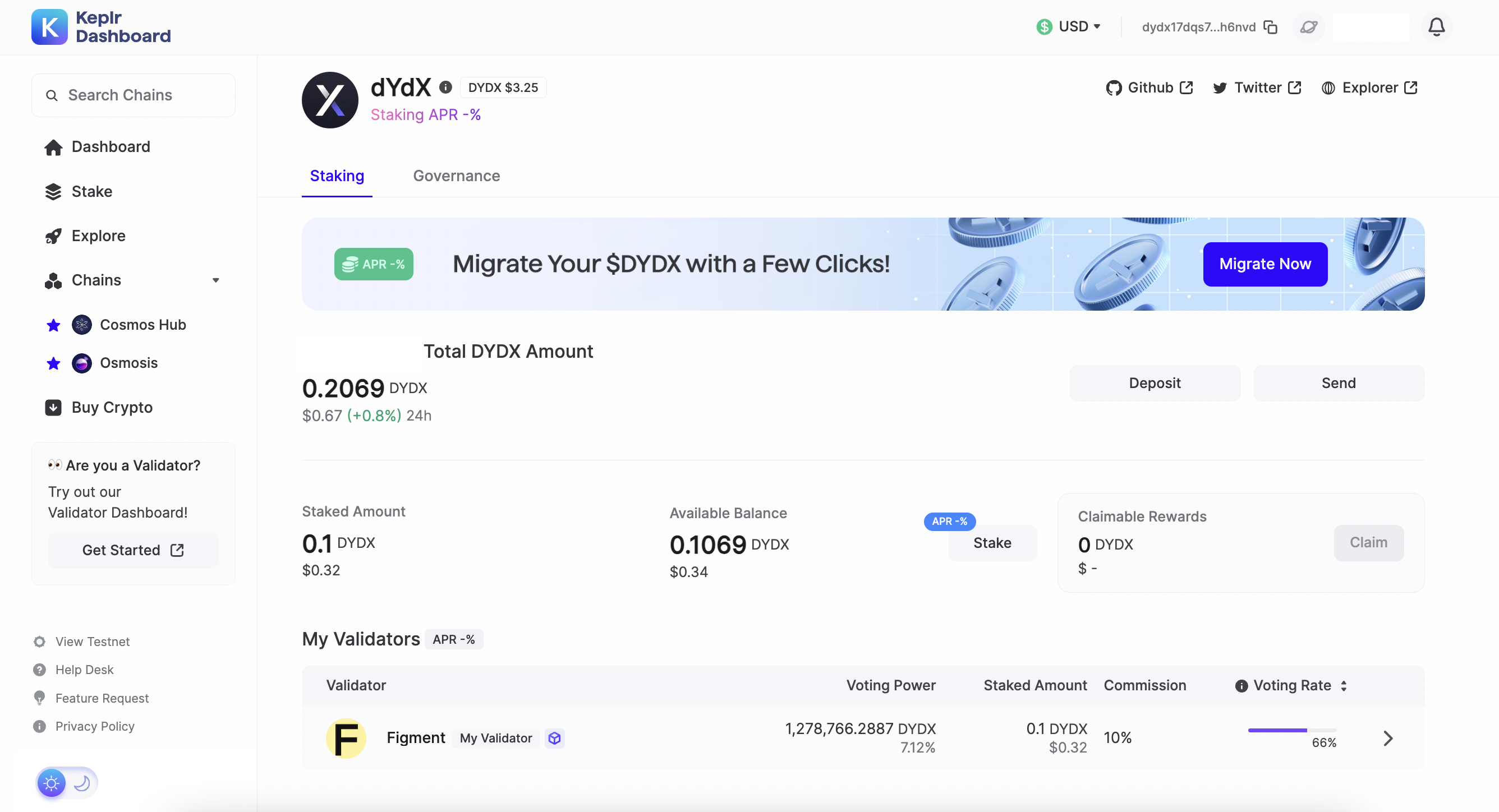

Once the transaction is confirmed, you will see a notification for this in the top right corner of the screen saying “Transaction successful.”

Below, you can now see your dYdX balance, along with the staked balance. Congratulations! You successfully staked dYdX tokens to Figment’s validator.

Start Staking Your dYdX

If you are interested in staking dYdX, Figment offers a host of services aimed at delivering safe and reliable staking rewards for your assets.

Over 250 institutional clients rely on Figment to provide best-in-class staking services including seamless and easy integrations, detailed rewards reporting, insights, double sign slashing, and downtime penalty coverage. Figment’s team has extensive dYdX knowledge intended to help dive into the specifics such as rewards and staking information. Meet with us to learn more about dYdX staking.

The information herein is being provided to you for general informational purposes only. It is not intended to be, nor should it be relied upon as, legal, business, or investment advice. Figment undertakes no obligation to update the information herein.