Staking Ethereum offers a unique opportunity for token holders to secure the network and earn rewards in the process. By contributing to the stability and security of the Ethereum network, token holders are rewarded with freshly minted ETH and transaction fees, making it a beneficial relationship between the protocol and the staking participants. Serving as a validator, Figment takes on vital responsibilities such as storing block data, validating transactions, and adding new blocks to the blockchain.

When it comes to Staking on Ethereum, there are a few different methods: protocol, pooled, and liquid staking. The article will walk you through the various methods, explaining the benefits, risks, and options for stakers.

Protocol Staking

The term “protocol staking” typically refers to staking as the protocol intends. Protocol staking Ethereum enables token holders to earn rewards by locking up their ETH tokens in order to validate transactions on the blockchain, which helps ensure the security and functionality of the network. In this case, with Ethereum, protocol staking requires 32 ETH to activate a single validator.

On Ethereum each round of validation (aka “epoch”) lasts 6.4 minutes. During the validating process, validators are randomly grouped into “committees” and assigned to a particular block. For each new block added to the chain, a single validator is selected by the protocol to “propose” each block, while the other validators attest that the proposer’s block is valid. Once the block has been finalized on-chain, then, only the Ethereum validator who was chosen to propose the new block receives their reward. From a single validator’s perspective, being elected to propose a block can be a very frequent or infrequent event because of the randomized selection process and generally comes with a large reward. Read more about Ethereum rewards dynamics here.

Providing Ethereum staking services requires technical expertise, infrastructure setup, and staying up-to-date with network upgrades.

Protocol Staking with Figment

Protocol staking allows stakers to maintain more control over their validators and infrastructure. When participating in Protocol Staking, each validator is activated with the full amount of 32 ETH, so there is no risk of pooled, or shared ETH.

Figment simplifies the Ethereum staking process. When users sign into the app, they are able to maintain control of their crypto assets, earn rewards, and track performance. The Figment app allows users to sign up and seamlessly stake ETH on an easy-to-use interface.

Staking ETH with Figment is truly non-custodial, allowing users to maintain setting the validator’s withdrawal address to an address you control.

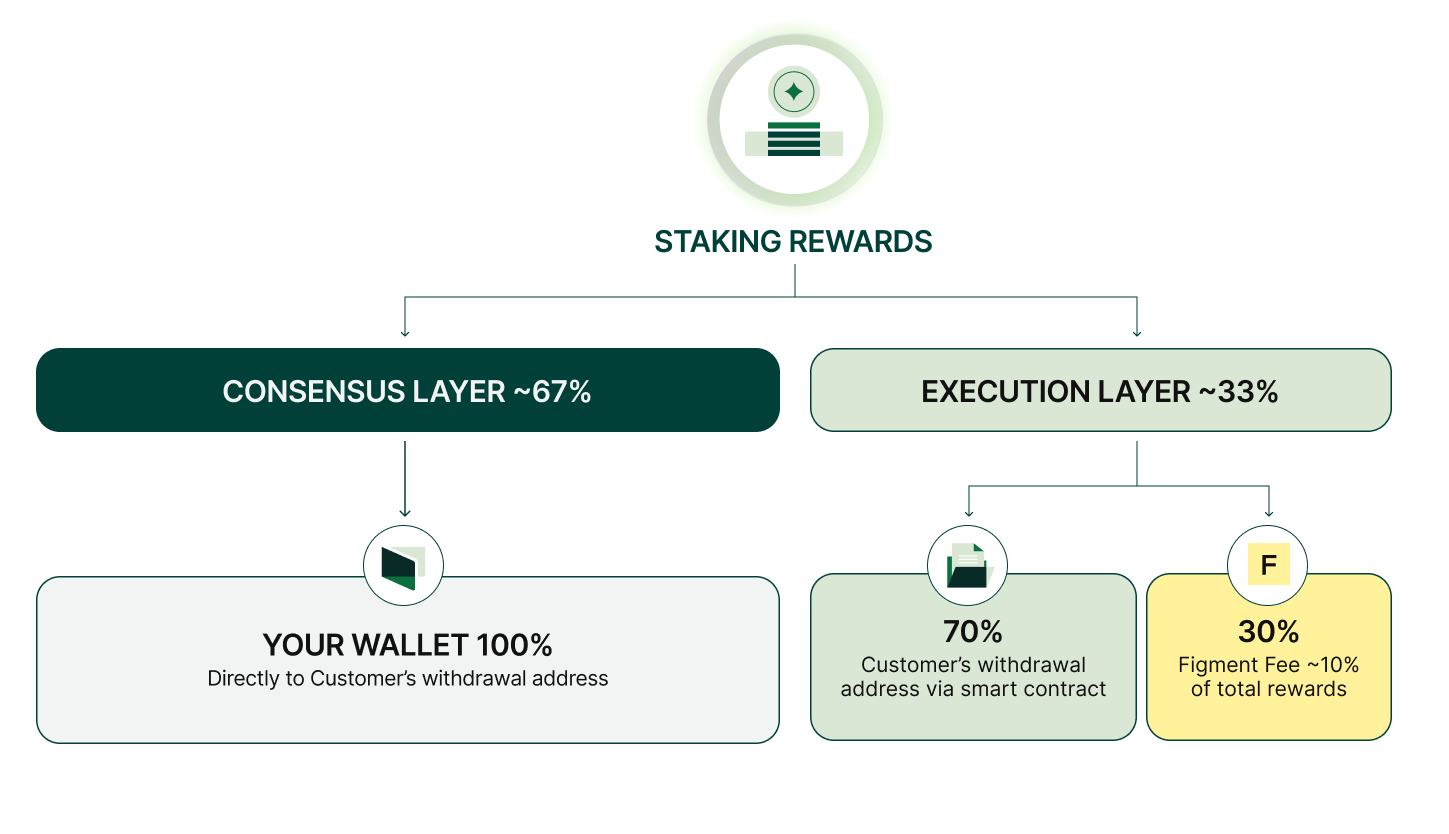

The Figment app allows users to keep 100% of their consensus layer (CL) rewards, and Figment’s current fee is 30% of execution layer (EL) rewards.

The fees are automatically deducted on-chain by an audited, individual smart contract eliminating the need for off-chain invoicing. Our on-chain billing model uses customer-specific smart contracts for processing billing fees which maintain a balance 0 ETH, acting only as a pass-through mechanism to split rewards between the appropriate parties.

CL rewards are sent to the validator’s withdrawal address, the same address that will receive your 32 ETH principal, per Ethereum’s design. Therefore, a contract that splits CL rewards will also receive your 32 ETH principal. If that contract is upgradeable or pausable, the deployer could stop you from receiving your funds back, or direct it to another place. The deployer could also be hacked and a malicious third party could do this. By only taking a fee on execution layer rewards, our billing smart contract will never hold customer funds and rewards automatically go to the customer’s recipient address upon receipt. Learn more about our on-chain billing solution here.

Custody

There are no custody requirements for Protocol Staking.

Staking with Figment is non-custodial and the app supports MetaMask and all Wallet Connect-compatible wallets, which includes many from leading custodians.

Considerations & Risks

Users can run their own Ethereum validators, however it’s important to keep in mind that running your own validators is a laborious process. One that requires the purchase and maintenance of hardware to run and upgrade software, generate and securely store validator keys, maintain a reliable internet connection, and stay aware of any network or critical client upgrades.

Regardless of whether you are running your own hardware or using a staking service provider, it is important to understand that validators can be penalized for wrong performance on the network due to double signing, and downtime offenses.

Figment offers peace of mind to its customers by running some of the industry’s most robust infrastructure, including a SOC 2 and ISO 27001 certified environment, as well as holistic coverage to mitigate risks associated with slashing events. Figment is also the first staking provider to contractually commit to offering double sign slashing alerting.

Pooled Staking

Staking pools are different from protocol staking. Known as pooled staking and staking pools, Ethereum users can stake their ETH together with other users to validate transactions and earn staking rewards, without needing to set up and maintain validator infrastructure individually. When protocol staking, you are the sole “owner” of your validator, while with pooled staking, you share the validator with other stakers.

Pooled staking is possible through a smart contract controlled by the pool operator. Once this smart contract “pools” 32 ETH together, the pool operator aggregates deposits from all users to amass the 32 ETH needed to run validator nodes. Then, the pool operator runs validator nodes and software to validate transactions and propose blocks on the Ethereum network. Rewards earned by the validator nodes are shared proportionally among pool depositors based on the amount of ETH they contributed.

Figment does not offer Pooled Staking

We do not offer staking pools or pooled staking. At this time, Figment only offers protocol staking for established and emerging networks.

Custody

Using staking pools means the pool operator has custody over your funds. As a user, you are relying on the staking pool to manage the staking process and pass on your staking rewards based on your contribution and the agreed terms.

A “custodial” Ethereum staking solution is one such that the staker does not retain custody of the withdrawal address for their validator(s). Solutions that involve another party having custody of the withdrawal address as an externally-owned account (EOA) or contract account are considered custodial.

Custodial solutions may manifest in various scenarios:

- In instances of staking sub 32 ETH, the solutions need funds deposited into an upgradable smart contract. This smart contract operates as a distinct product managed entirely by its creators.

- Throughout the deposit and withdrawal process, the staked ETH is routed to a smart contract under the control of the staking-as-a-service provider.

A potential security risk emerges as the staking platform retains authority over the unstaking process, thus possessing the ability to unilaterally censor customer transactions and lock out the customers’ deposits.

Considerations & Risks

While staking pools can provide an easy way for users with less than 32 ETH to participate in Ethereum staking, they do come with some key custody and smart contract risks to consider.

Pooling requires users to deposit their ETH into a smart contract controlled by the pool operator. This means the pooled ETH is held together rather than in separate accounts, creating a central point of failure. If the smart contract code has a flaw, funds for all users in the pool could be lost or stolen. On top of this, if the pool operator’s systems are compromised, the entire pool’s assets are at risk. This is in contrast to an approach like running your own validator node, or staking with Figment where your ETH remains directly in your custody.

Also, with any type of Ethereum staking, validators can be penalized for poor or incorrect performance on the network due to double signing, downtime, missed rewards, and slashing.

Liquid Staking

While Ethereum staking normally involves locking up increments of 32 ETH, liquid staking unlocks this illiquidity and allows users to stake any amount of ETH, even fewer than 32 tokens. This can be done by using a protocol like Liquid Collective. Liquid staking allows you to stake any amount of ETH while receiving “liquid staked ETH”receipt tokens in return.

For example, with Liquid Collective you can stake your ETH and receive LsETH tokens. These LsETH tokens can be freely traded or used in DeFi protocols to earn rewards. Meanwhile, your staked ETH continues to earn staking rewards in the background. The LsETH tokens are tied to the staked ETH assets and can be redeemed 1:1 when you want to unstake. This helps users gain access to liquidity while still receiving some of the benefits of staking.

Liquid Staking with Liquid Collective

Figment is a validator operator and integrator of Liquid Collective (not available for US customers via Figment).

If you are interested in seeing this process in action, watch our Liquid Collective video staking guide.

Custody

There are no custody requirements for liquid staking.

Considerations & Risks

Similar to any protocol providing a service, there are risks associated with liquid staking, including the potential for smart contract code vulnerabilities that are missed by third-party auditors. There is also often increased centralization, where large liquid staking pools can control significant amounts of the staked ETH supply. While liquid staking provides convenience and liquidity, users must weigh these benefits against risks like reduced control and smart contract exposure.

Also, with any type of Ethereum staking, validators can be penalized for poor or incorrect performance on the network due to double signing, downtime, missed rewards, and slashing.

In Conclusion

Ethereum offers several pathways for token holders to participate in staking. The term “protocol staking” typically refers to staking as the protocol intends. Staking pools are different from protocol staking, where Ethereum users can stake their ETH together with other users to validate transactions and earn staking rewards. And finally, liquid staking unlocks liquidity and allows users to stake any amount of ETH, fewer than 32 tokens.

Ultimately, the ideal staking approach depends on each user’s priorities. No single model is universally “better” – rather, Ethereum staking is now diverse enough for users to choose their optimal balance of control, liquidity, and ease-of-use. Looking ahead, Figment strives to be a leader in developing staking solutions as the ecosystem evolves – serving the spectrum of user needs and priorities.

Staking Ethereum With Figment

Figment is the largest independent ETH staking provider with almost a 5% share of staked ETH. If you are interested in staking Ethereum, Figment offers a host of services aimed at delivering safe and reliable staking rewards for your assets.

Our 250+ institutional clients rely on Figment to provide best in class staking services including seamless and easy integrations, detailed rewards reporting, insights, MEV-Boost activation on ETH, double-sign slashing, and downtime penalty coverage. Figment’s team has extensive Ethereum knowledge intended to help dive into the specifics such as rewards and staking information. Meet with us to learn more about Ethereum staking.

The information herein is being provided to you for general informational purposes only. It is not intended to be, nor should it be relied upon as, legal, business, or investment advice. Figment undertakes no obligation to update the information herein.