Mina bills itself as the “world’s lightest blockchain.” Mina claims that their blockchain will always stay the same size (about 20 kilobytes) regardless of how many individuals use it. Twenty kilobytes is the equivalent of a handful of tweets. Because of this size, Mina will be downloadable by anyone who has basic storage and internet access. Staking MINA will allow MINA token holders to earn reward while helping secure the network.

Ready to stake? Head here.

Why Stake with Figment?

EXPERIENCED & TRUSTED

- Figment is a venture-funded, registered Canadian company based in Toronto. Canada offers stability, rule of law, and clear crypto regulation.

- Servicing the world’s largest MINA holders.

- 30+ years of experience successfully scaling internet infrastructure companies.

FEATURES & BENEFITS

- Our Commission rate is 10%.

- Figment Prime & discounts available for large MINA holders. Contact us for more information.

- Active participant in the Mina ecosystem.

SECURITY & SAFETY

- The world’s most advanced physical IDC + multi-cloud staking infrastructure.

- You maintain the custody of your MINA at all times.

- Third-party custody solutions are available through our institutional partners. Contact us for more information.

COMPLIANCE

- Protected via industry-leading Staking & Delegation agreement.

In this guide, we have included instructions to delegate to a Figment validator with our custodial partner, Finoa, how to delegate using the community built Clorio wallet, and links to delegate with CLI. We’re building a staking interface for Mina with Ledger in a web app on Hubble, so keep your eyes peeled for that. We’ll announce that interface when it’s ready to be used by the public.

MINA Staking & Delegation Guide

MINA Staking with Figment & Finoa

Figment is working with Finoa as our custody partner for Mina. Delegations are initially hardcoded into the genesis block. At the current time, Finoa doesn’t allow delegators to switch to other validators.

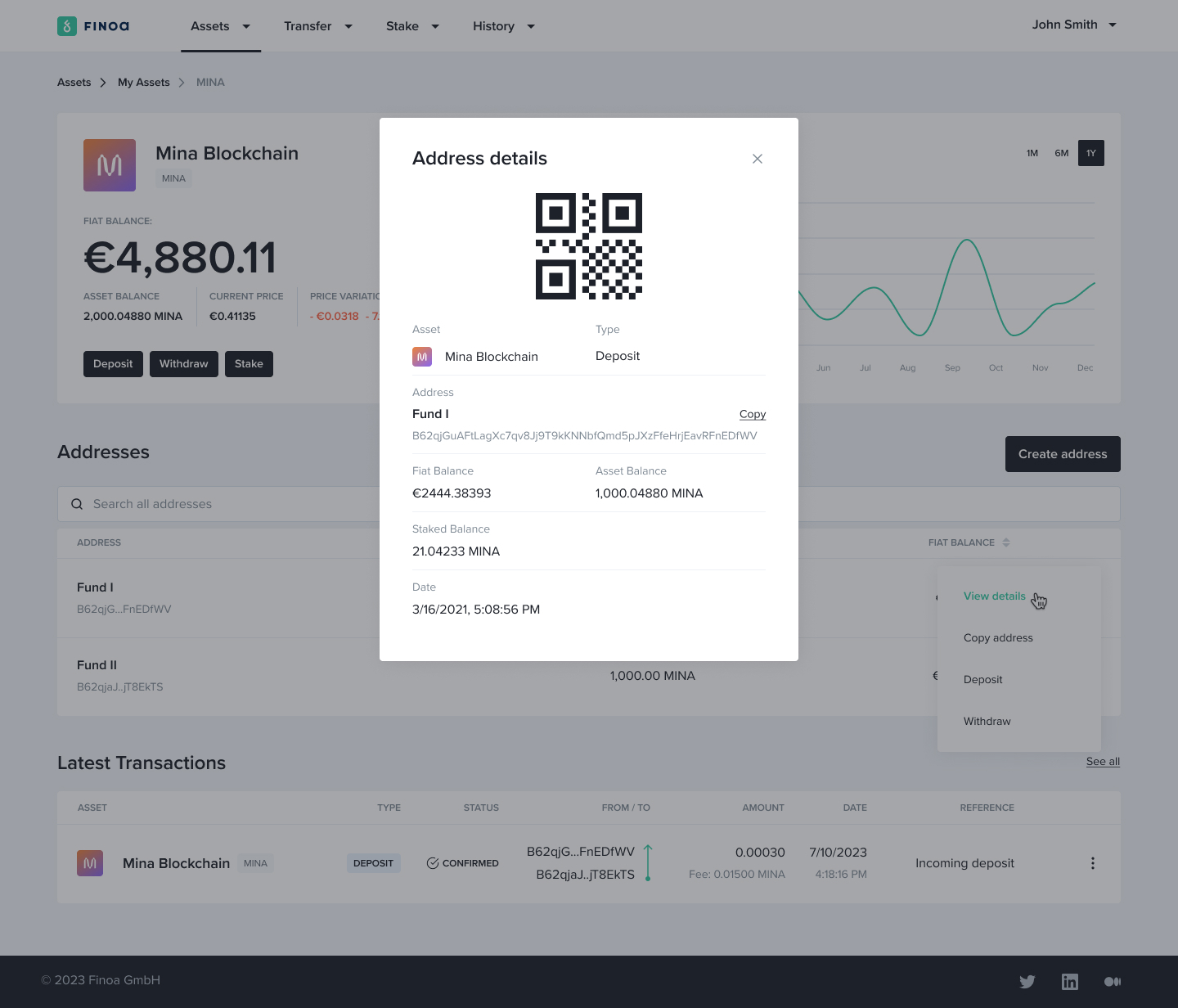

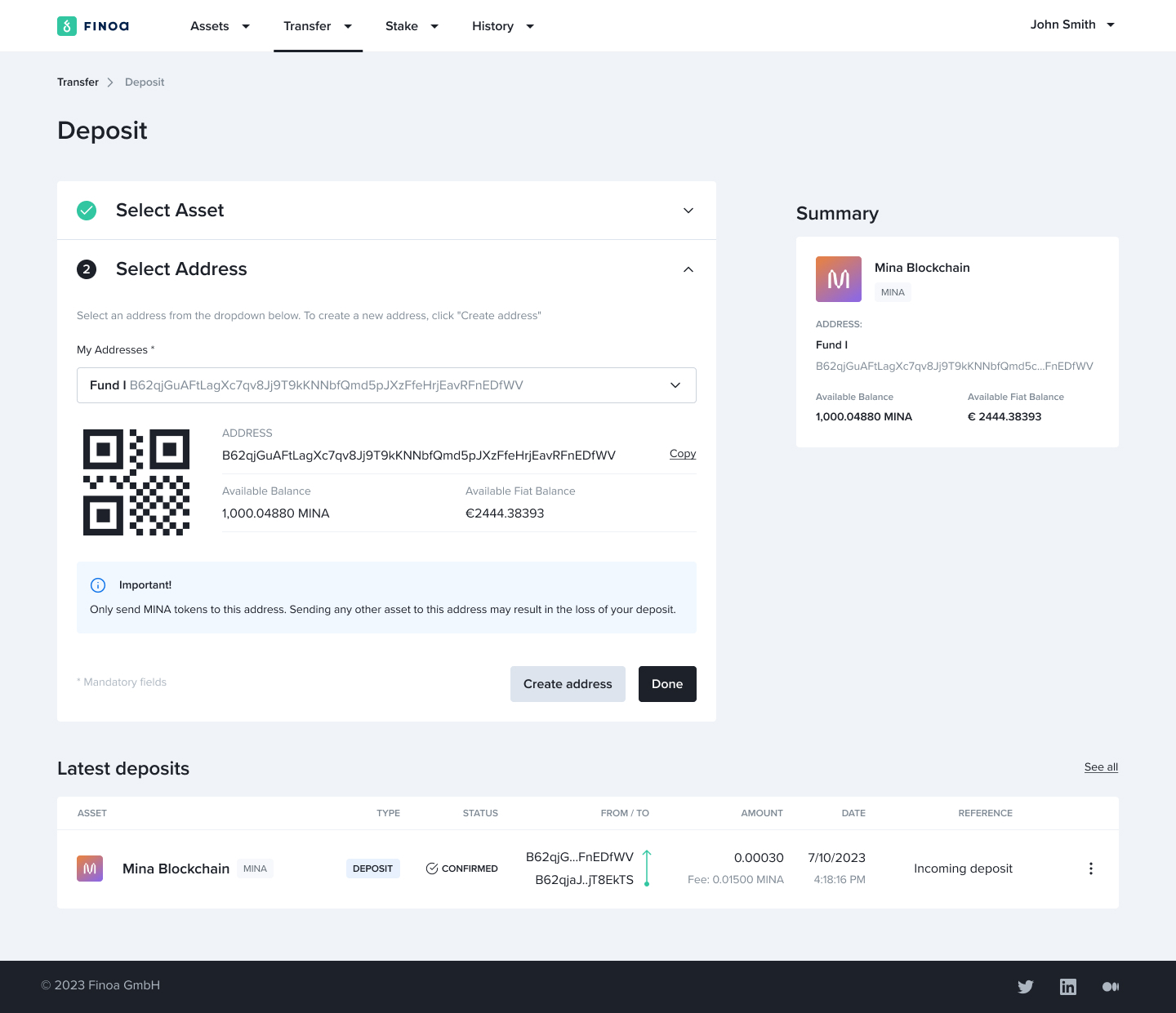

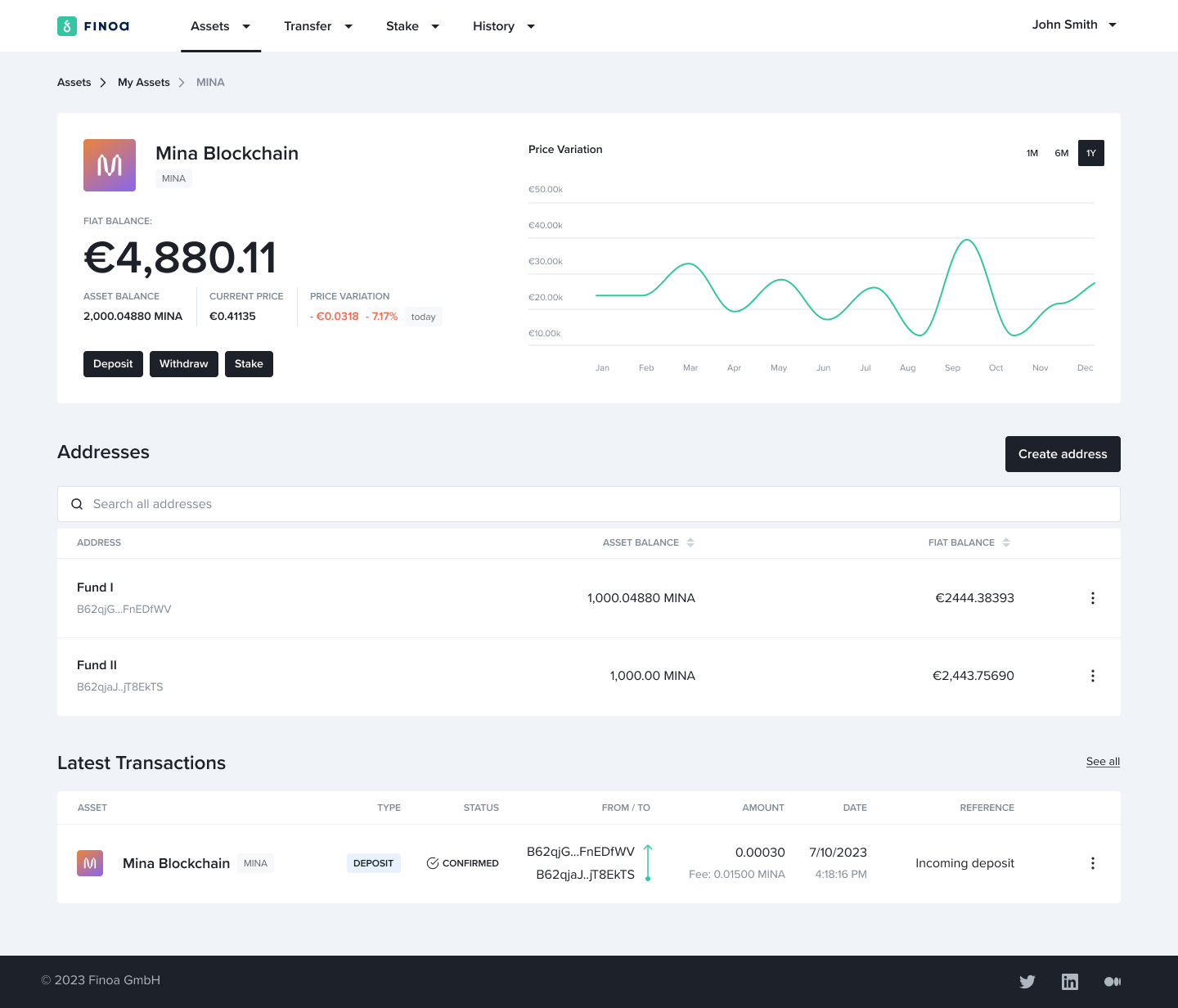

Users can find their MINA address in the Funds section by clicking on “view details” to show their address.

Every customer has been provided with two initial addresses from the MINA foundation. The distribution of the MINA tokens into these addresses may vary from customer to customer.

Since the initial delegations will be hardcoded into the Mina genesis block, switching block producers directly in Finoa is not currently available. Finoa will set a team to build a specialized tool to manage MINA delegations and rewards directly through the interface.

Other important information when delegating with Finoa:

- Addresses may delegate to only one block producer.

- Epochs on Mina last ~14 days.

- Block producers are responsible for paying out rewards to delegators. Figment is currently developing a strategy to optimize payouts for Finoa customers.

- MINA generated from staking rewards are liquid and free to transfer.

- Validators payout rewards directly to their delegators; therefore, the staked amount increases automatically every time a validator makes a payout.

- Changes in delegations, such as increasing or decreasing the delegated amount, will require an epoch to take effect.

Since epochs are 14 days, if a delegator starts staking on Day 7 after the epoch begins, that delegation will be applied on Day 29, at the third epoch. Any time a delegator changes their stake weight, while there is technically no bonding period with Mina, keep in mind that it may take a few weeks before your stake delegation comes into effect.

MINA Staking with Clor.io

Now, if you are not technically savvy we have a way you can delegate and stake without using a single line of code. We also have a tutorial up on our YouTube Channel, which covers how to delegate with MINA.

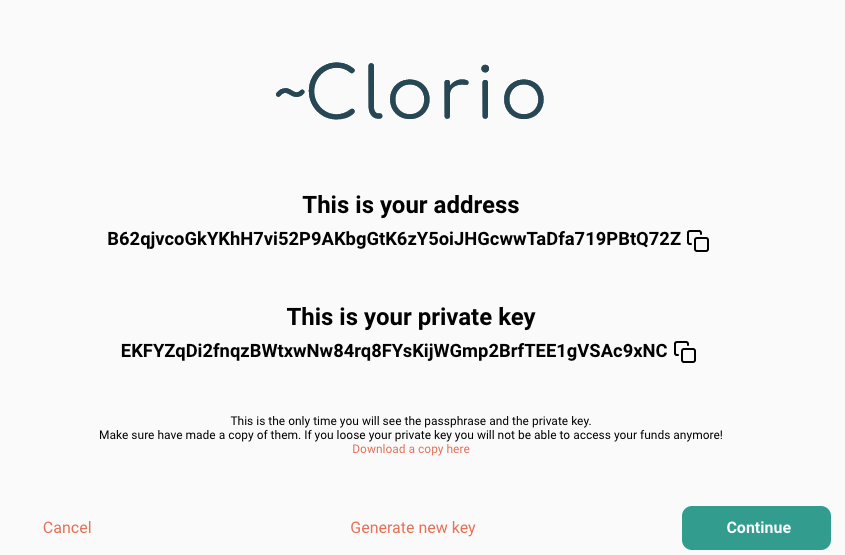

For this, we will be using the web wallet Clor.io created by Carbonara of westake.club. Clorio is an open-source wallet for Mina Protocol, built with Javascript. With Clorio you can interact with the Mina blockchain by generating/using your private key or by using the Ledger hardware wallet. Clorio wallet doesn’t send your private key out of the client app, all the transactions are signed in local or on your Ledger device.

The nature of ~Clorio is self-custodian, this means that you are the only one responsible for safe-keeping your private key. We cannot recover your lost keys or block transactions and we take no responsibility for software malfunction. You can check out their documentation here and hop in their discord if you’ve got questions.

On Clorio you can create a regular wallet and it will give you a public/private key-pair that you need to keep safe Clorio offers the possibility to download a paper wallet when you create your wallet for added security. Currently, the implementation is not the best, because you have to handle the private key everywhere (via copy and paste), the team is waiting for a feature in the Mina SDK that will enable them to provide users with a mnemonic seed, like many popular wallets.

They are also evaluating how to improve this and eventually store the key in the session if the user agrees, so no more copy & paste… But this is still being evaluated (every change needs to be reviewed from a security standpoint) so keep your eyes peeled for the updates.

So, let’s go ahead and head over to Clor.io and set up our web wallet.

You can either download the wallet directly to your desktop or delegate from the browser. You can access the wallet if you already have a private key or if you have a ledger.

We can start by “clicking create a wallet.”

The wallet will create a public address to send and receive MINA and a private key to access the wallet. This was used for demo purposes and doesn’t have any MINA in it – never share your private key with anyone.

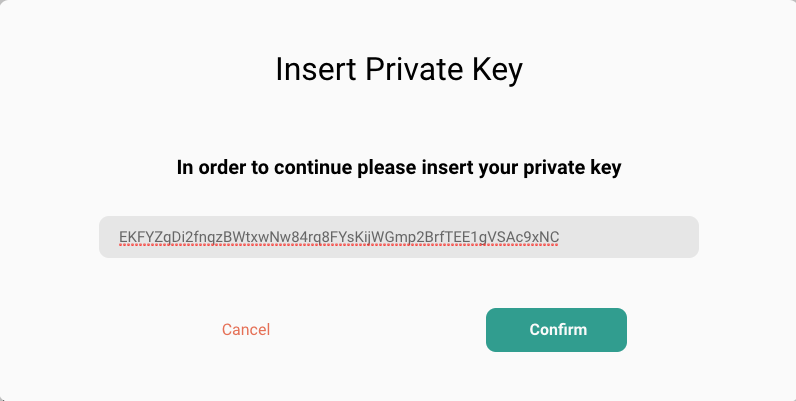

After clicking continue, you’ll need to verify your private key by entering it in the space provided.

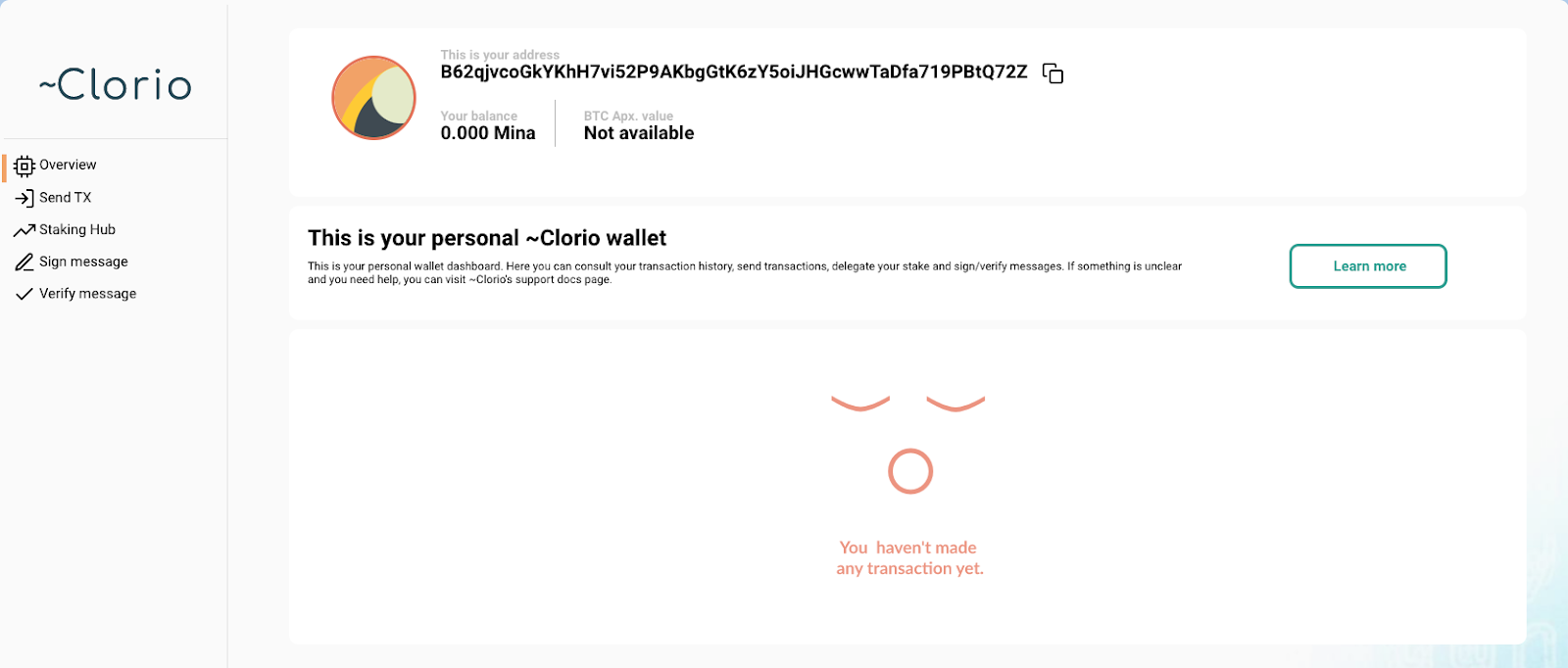

Clorio will then display the following interface and you now have access to your web wallet:

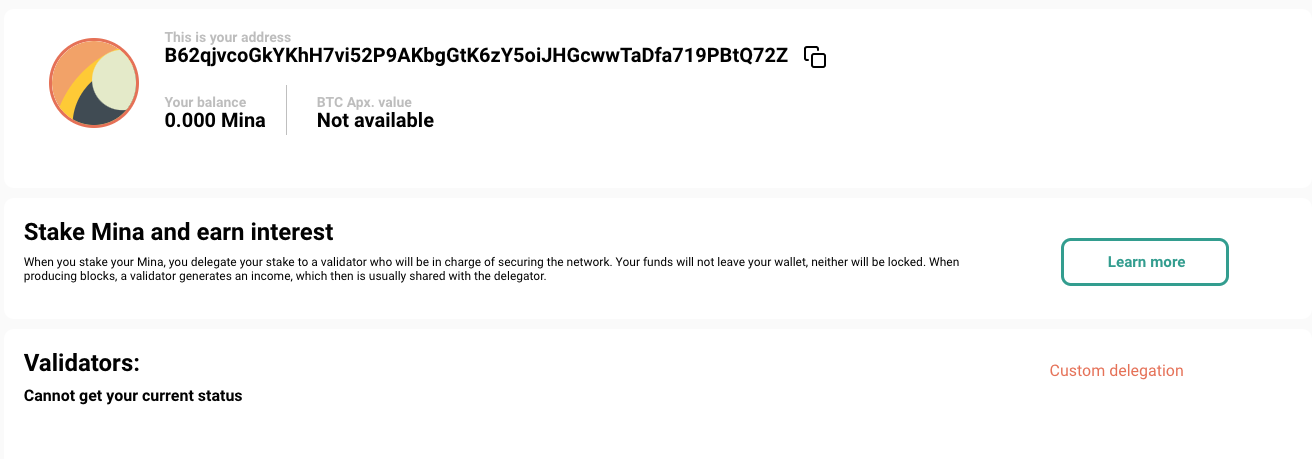

Navigate to the Staking Hub interface on the left side of the screen and select custom delegation.

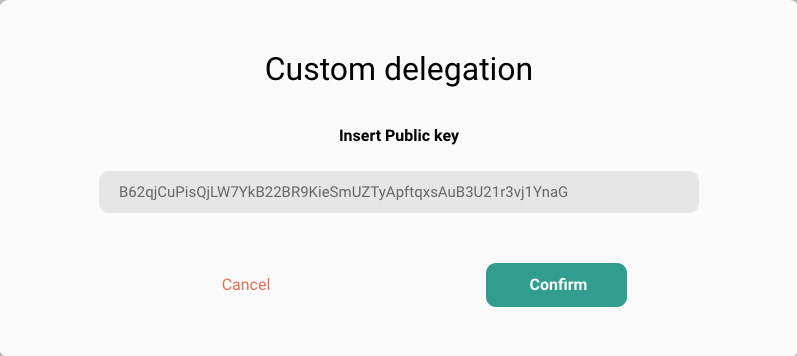

In the field, enter Figment’s Public Key:

B62qjCuPisQjLW7YkB22BR9KieSmUZTyApftqxsAuB3U21r3vj1YnaG

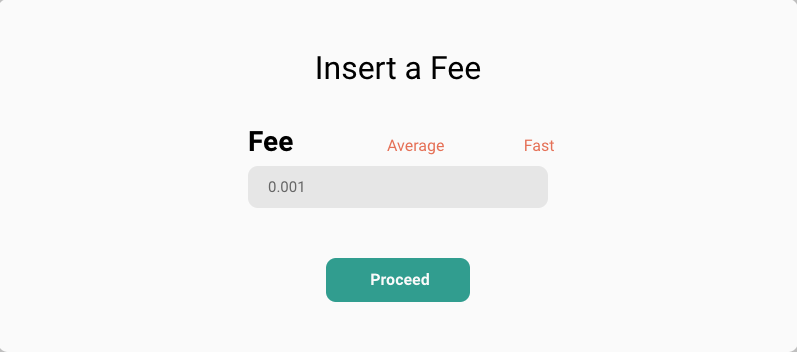

Click Confirm, select your fee:

Click Proceed; Insert your private key and click confirm

If you’ve got enough funds and your key is valid, the modal will disappear, then will pop out an alert on the bottom right side of the screen confirming that your transaction has been successfully broadcasted to the network.

That’s it! You will start to earn rewards on the network with Figment. There will be a latency period of 7 to 14 days, before your stake will start to earn rewards.

MINA Staking with Command-Line Interface (CLI)

If you are technically savvy and have a hardware wallet, we’ve included how to delegate to Mina using CLI. If you are new to operating a hardware wallet, we’ve got some instructions on setting up Ledgers and SafePal Wallets.

Neither Ledger nor SafePal’s software supports staking with Mina, but not to worry – you can still delegate anyway following these instructions via a CLI.

First, if you haven’t already, you’ll need to generate a keypair and connect to the network.

Second, make sure you’ve unlocked your account and enter the following in the terminal:

mina account unlock -public-key $MINA_PUBLIC_KEY

Then run this command to delegate your stake:

mina client delegate-stake

-receiver <DELEGATE-PUBLIC-KEY>

-sender $MINA_PUBLIC_KEY

-fee 0.1

- The receiver is the public key of the validators to receive your stake delegation.

- The sender is the public key of the account from which you want to delegate

- The fee is the transaction fee required to record your transaction.

Figment’s Public Key:

B62qjCuPisQjLW7YkB22BR9KieSmUZTyApftqxsAuB3U21r3vj1YnaG

Note: there is a 2-4 week delay (also known as a latency period) before your new stake delegation comes into effect.

Token Supply and Lockups

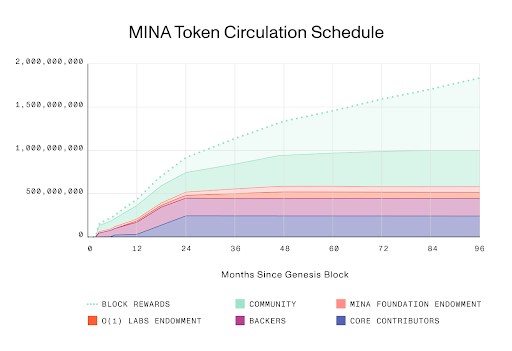

Mina will distribute all of their tokens (1 billion) at launch, and they will slowly unlock over eight years.

At genesis, tokens are deposited to the intended token holder’s MINA address. These locked tokens cannot be transferred out of these accounts, but they can be staked or delegated. As tokens unlock on their schedule, they can be transferred to another account. Holders cannot move more tokens than what the protocol has unlocked; otherwise, the transaction will fail.

For those curious about token economics details, the Mina team recently published a blog post about token distribution and supply.

Calculating Rewards for Stakers

On Mina, validators are the ones to select whether rewards are compounded, and they determine the payouts to their delegators. These are two things that are important to calculate the rewards rate and the compounding rewards rate.

By putting the payout and compounding rewards on validators’ responsibility, Mina gives more control to delegators to control the market. Delegators have more incentive to pick a validator that will provide them with the best rewards rate. But this also means that delegators are responsible for knowing how compounding rewards and validator payouts impact their rewards rate.

It’s generally a good idea to find this information from a validator from their social platforms, telegram, etc. Delegators can find some of these links on the validator dashboard.

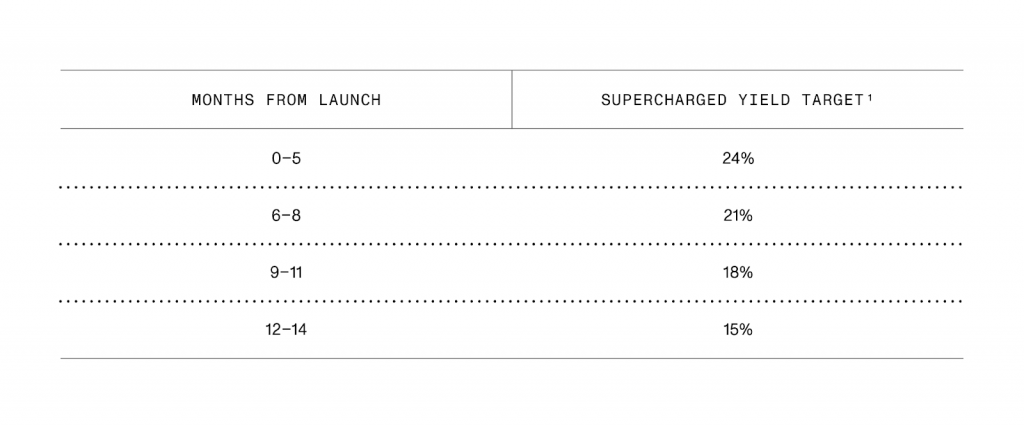

Mina aims to have a high percentage of the network staked, even as more tokens become unlocked (providing more liquidity on the network). Mina will pay out extra block rewards whenever a block is produced by an address that does not have any time-locked tokens. If the delegating account is also unlocked, they receive what Mina is calling “Supercharged Rewards.” These accounts will receive a higher APY as a reward for continuing to stake, despite the option to stop and withdraw tokens.

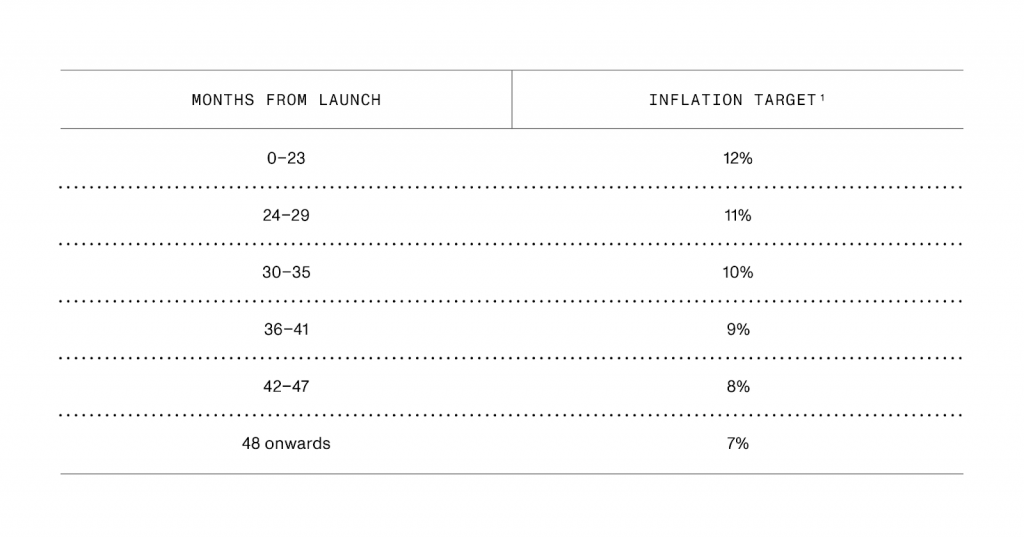

Mina is planning on a 12% inflation (also known as issuance) rate for the first two years if all tokens are staked. Based on that, we can calculate an approximate reward rate.

- If 70% of the network is staked, then rewards will be 17%

- If 80% of the network is staked, then rewards will be 15%

- If 90% of the network is staked, then rewards will be 13%

After the first two years, the inflation rate will decrease 1% every five to six months until reaching 7% (roughly four years after launch).

This rewards rate is calculated before commission fees, which are also available on the validator dashboard.

If you would like to stake with us and Finoa or need help staking with CLI, we’re happy to help out.

Reach out: support@figment.io

Frequently Asked Questions

Where can I explore the network and create a Mina wallet?

Find Mina’s block explorer here.

You can check out the validator dashboard for mainnet, which has validator statistics like their commission rate, the amount staked, and the number of delegators they have. Delegators can also find links to their contact information and social networks.

What is the name of the asset being staked?

Mina’s native token, MINA, is used to stake and to participate in on-chain governance.

When are staking rewards enabled? When are transfers enabled?

Staking rewards are enabled at the launch of the mainnet. Transfers will be enabled as tokens become unlocked. Tokens purchased during the Community Sale will be locked for 40 days after mainnet launch. The protocol will unlock 20% of Mina Foundation tokens at the launch of the mainnet. Afterward, the rest of the tokens will be unlocked continuously over the next 3.5 years, beginning six months after launch.

How long does it take to stake & unstake MINA?

There is not a bonding period after the initial token lock-ups.

Do I maintain custody of my MINA tokens? Who or what controls my staked MINA token?

Figment is partnering with Finoa to serve as a third-party custodian, reach out to support@figment.io.

The Mina Protocol takes control of your MINA tokens while you are staking. As soon as you unbond your tokens, they are returned to you.

Can my staked MINA be slashed (seized or destroyed)?

No. Mina’s protocol is founded on the Ouroboros algorithm. Slashing is based on regulating the irrational behavior of validators by threatening them economically (aka. threatening their stake if caught with downtime or double signing). Ouroboros, by design, incentivizes all stakeholders to act rationally.

Is MINA staking income liquid or automatically staked?

Validators handle payouts, and automatically staking rewards can be automatically staked. Validators can choose not to send rewards or send them when it suits them.

Can I lose potential MINA staking rewards?

While there isn’t any slashing, delegators will not gain rewards if their validator goes offline.

What is the rate of new issuance (aka “annual inflation”) for MINA? How does the token supply change?

Mina’s inflation will begin at 12%. Over the next five years, the inflation rate will fall to 7% – unless specified or changed through governance.

How are decisions about Mina made and executed?

Details about governance have not been released yet by the team.